Subsidy Loan Consultant in Ahmedabad | CA - AAK...

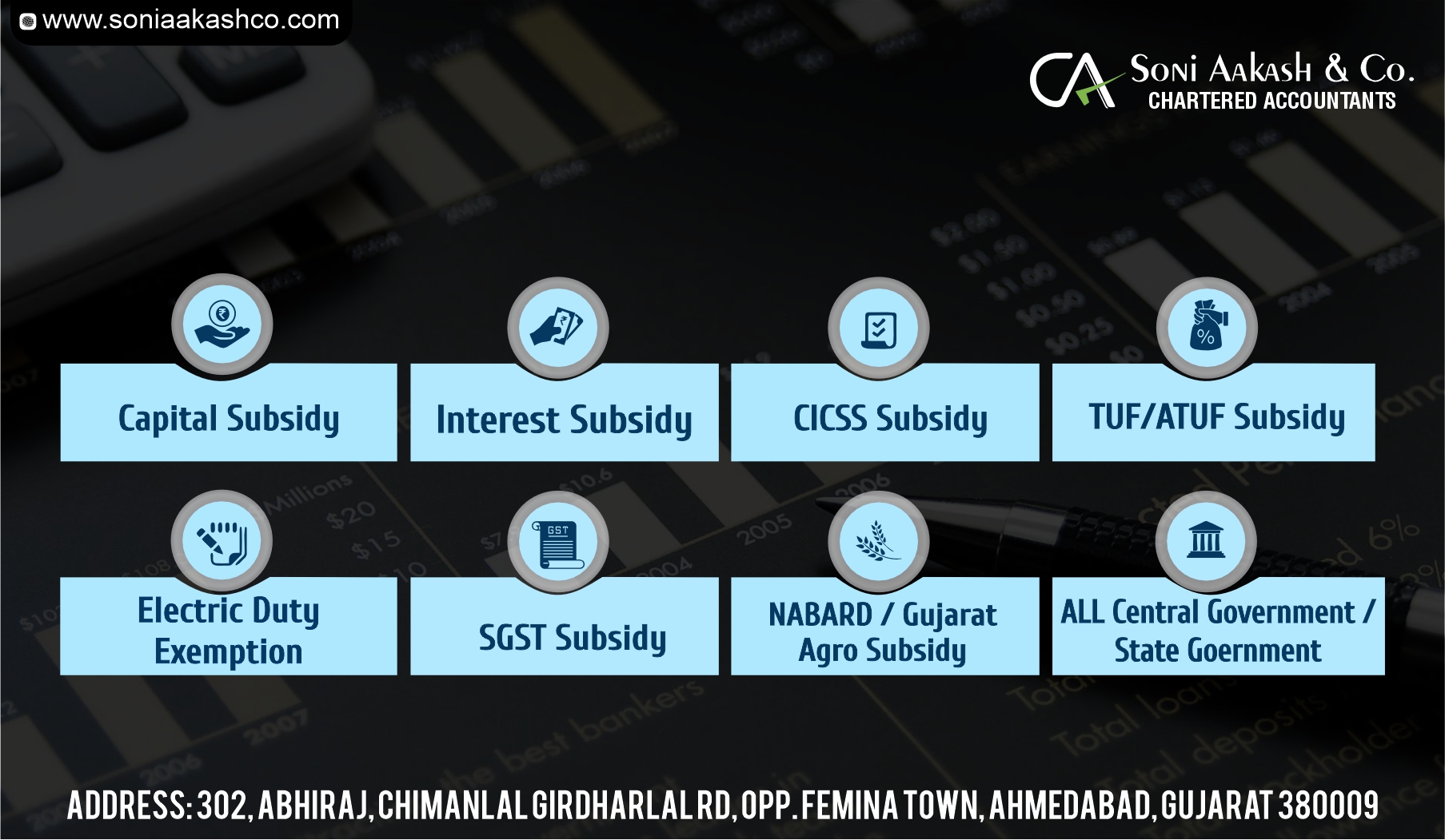

Subsidy Loan Consultant in Ahmedabad | CA - AAKASH SONI & COMPANY - AHMEDABAD, GUJARAT INDIA. Subsidy Loan Consultant Services refer to services provided by professionals or firms that assist individuals, businesses, or organizations in securing loans or financial assistance through government subsidies or subsidy programs. These consultants have expertise in navigating the complex landscape of government subsidies, grants, or low-interest loan programs, and they help their clients access these financial resources to support various projects or initiatives. Here are some key aspects of subsidy loan consultant services: Program Research: Consultants stay up-to-date with government subsidy programs, grants, and low-interest loan opportunities available at the local, state, or federal level. They research these programs to identify the ones that best match their clients' needs. Eligibility Assessment: Consultants evaluate their clients' eligibility for specific subsidy or loan programs based on criteria such as location, industry, project type, and more. Application Assistance: They help clients complete and submit subsidy or loan applications, ensuring that all required documentation and information are included. Financial Planning: Consultants may assist in creating comprehensive financial plans, budgets, and project proposals to enhance the chances of securing funding. Compliance and Reporting: After obtaining the subsidy or loan, consultants often provide guidance on compliance with program requirements and help with reporting and documentation to maintain eligibility for the funding. Strategic Advice: They offer advice on how to strategically utilize the funds obtained through subsidies or loans to achieve specific goals or objectives. Networking: Subsidy loan consultants often have established networks and relationships with government agencies, financial institutions, and other stakeholders, which can be valuable in securing funding. Monitoring and Updates: Consultants may continue to monitor subsidy and loan opportunities and inform their clients of new programs or changes in existing ones. These services can be especially beneficial for small businesses, startups, non-profit organizations, or any entity seeking financial support for a particular project or expansion. The expertise and guidance of subsidy loan consultants can streamline the application process, increase the chances of approval, and ensure that clients maximize the benefits of the financial assistance they receive. Before hiring a subsidy loan consultant, it's essential to do your due diligence, check their credentials, ask for references, and ensure that their services align with your specific needs and objectives. Additionally, be aware of any fees or commissions associated with their services. We’ll ensure you always get the best guidance.

Keywords

Subscribe for latest offers & updates

We hate spam too.